arkansas estate tax statute

Though your estate will not be subject to Arkansas estate or inheritance tax it is possible that federal taxes could affect your estate. 26-59-112 - Director to make return when no return filed.

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

This includes Sales Use Aviation Sales and Use Mixed Drink Liquor Excise Tourism Short Term Rental Vehicle Short Term Rental Residential Moving Beer Excise and City and County Local Option Sales and Use Taxes.

. Restaurants In Matthews Nc That Deliver. Restaurants In Wildwood Nj Open Year Round. Online payments are available for most counties.

26-59-111 - Estate tax return -- Extension of filing time. Be sure to pay before then to avoid late penalties. 26-59-106 - Amount of tax imposed -- Resident estates.

An executor can charge a reasonable fee for managing an estate in Arkansas. According to Amendment 79 the taxable value cannot exceed. Pay-by-Phone IVR 1-866-257-2055 The statewide property tax deadline is October 15.

A sale is defined as a transfer of title or possession. The current tax rate is between 35 percent and 55 percent for any amount above the exemption depending on how much you have so this can amount to a significant loss of assets for your family or other heirs. Fiduciary and Estate Income Tax Forms 2022.

26-59-110 - Estate tax returns -- Contents. 26-59-108 - Exemptions. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

2 All taxes unpaid after October 15 are delinquent. Want to avoid paying a 10 late penalty. Soldier For Life Fort Campbell.

Arkansas Adverse Possession Laws. Property Taxes and Property Tax Rates Property Tax Rates Each Arkansas city and county collect property taxes and the tax is charged at 20 of the. 26-59-107 - Tax imposed -- Nonresident estates.

They will be given a bidder number which they will use for the auction. Justia US Law US Codes and Statutes Arkansas Code 2010 Arkansas Code Title 28 - Wills Estates and Fiduciary Relationships Subtitle 4 - Administration Of Decedents Estates Chapter 41 - Distribution Without Administration 28-41-101 - Collection of small estates by distributee. FindLaw Newsletters Stay up-to-date with how the law affects your life Enter your email address to subscribe.

AR4FID Fiduciary Interest and. Delivery Spanish Fork Restaurants. Arkansas Estate Tax Statute.

This is a quick summary of Arkansas probate and estate tax laws. Those Arkansas estates who fall below this threshold will not owe any federal or state estate tax. Arkansas sales tax generaly lapplies to the entire gross receipts of all sales of tangible personal property and certain specifically enumerated services within the State of Arkansas.

The process however can take longer for contested estates. Amendment 79 to the Arkansas Constitutionalso known as the Property Tax Relief amendmentprovides limitations on the increase of the propertys taxable value during county-wide reappraisals. The exemption amount will rise to 51.

While there arent any specific amounts or percentages for the fees they do have limits. Heirs will not be subject to an inheritance tax with the one exception noted above nor will they have to worry about income tax consequences. 26-59-109 - Estate tax returns generally.

Opry Mills Breakfast Restaurants. The Department bears the burden of proving that the tax law applies to an item or service sought to be taxed and a taxpayer bears the burden of proving entitlement to a tax exemption deduction or credit. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc.

Arkansas Taxes Differ from Federal Taxes Arkansas does not have any estate tax or inheritance tax which is good news for heirs and beneficiaries in Arkansas. When You Meet The Love Of Your Life Lyrics. 26-1-101 personal property is defined as Every tangible thing being the subject of ownership and not.

New construction Newly discovered properties. Income Tax Rate Indonesia. Arkansas does not have a state inheritance or estate tax.

In arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely. In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely. Arkansas does not have a state inheritance or estate tax.

The executor of the estate is charged with the responsibility of computing filing and paying any and all estate taxes that are due. The state has general statute of limitations for tax collections of six years. A 1 All taxes levied on real estate and personal property for the county courts of this state when assembled for the purpose of levying taxes are due and payable at the county collectors office between the first business day of March and October 15 inclusive.

Personal Property- Under Arkansas law ACA. The state has general statute of limitations for tax collections of six years. Essex Ct Pizza Restaurants.

Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws. AR1002ES Fiduciary Estimated Tax Vouchers for 2022. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without.

These 5 and 10 caps do not apply to. Basics of Arkansas statutes governing the legal relationship between landlords and tenants including maximum security deposit allowed by law time limits for returning deposits and anti-discrimination laws. Arkansas charges a state sales tax rate of 65.

Inherited assets are considered to be ordinary income by the IRS and so income tax will not apply. According to law they cannot be more than 10 percent on the first 1000 value of the estate and five percent on the next 4000 and three percent of the remaining amount. Arkansas Estate Tax Statute.

Sales and Use Tax.

Learn More About Arkansas Property Taxes H R Block

Arkansas Inheritance Laws What You Should Know

Arkansas State Tax Information Support

Arkansas State 2022 Taxes Forbes Advisor

Arkansas Retirement Tax Friendliness Smartasset

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

Sponsored Deferring Real Estate Tax Gains Can Be An Effective Tax Strategy Arkansas Business News Arkansasbusiness Com

The Ultimate Guide To Arkansas Real Estate Taxes

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

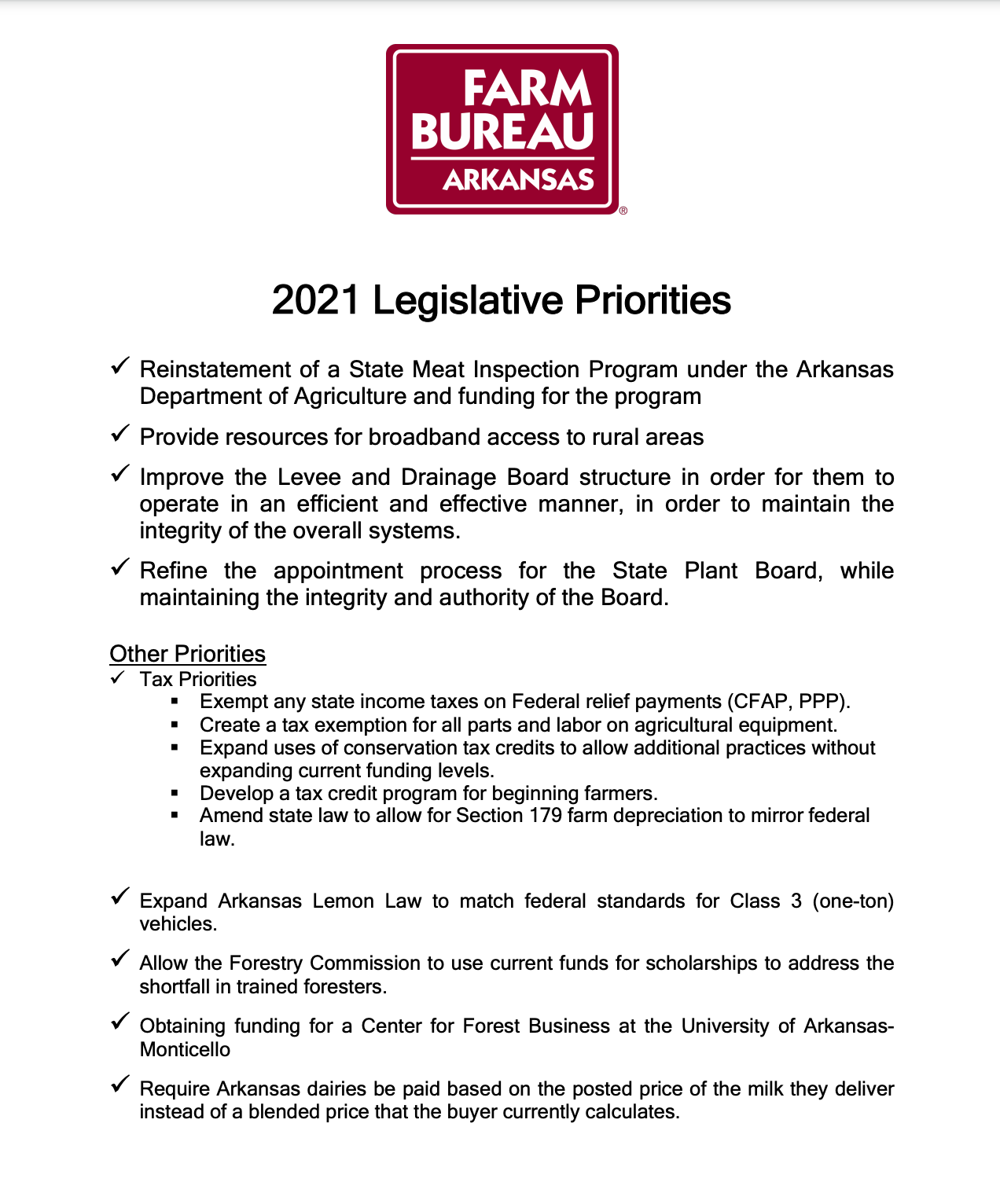

Advocating For Agriculture Arkansas Farm Bureau

Homestead Tax Credit Real Property Aacd

Arkansas Real Estate Transfer Taxes An In Depth Guide

Is There An Inheritance Tax In Arkansas

Arkansas Property Tax Calculator Smartasset