kane county illinois property tax due dates 2021

Kilbourne announced today Thursday April 22 2021 that Kane County property tax bills will be mailed on April 30. You may sign up with your email address to receive installment due date reminders and payment notifications for.

How To Pay Your Property Tax Bill In Kane County Il Kane County Connects

Rate 2020 Taxing District Tax 2021Tax 2020 Rate 2021 0289732 4724 KANE COUNTY 0282169 4707.

. Property Tax Appeal Board. 209 of home value. Kane County Treasurer 719 S.

The Kane County Treasurers Office has posted a notice on its website saying unpaid Kane County property taxes are now considered delinquent. County officials will conduct a tax sale on Feb. Failure to receive a tax bill or receiving one late for any reason will not relieve the taxpayer from paying taxes or late penalties.

Last day to submit changes for ACH withdrawals for. Batavia Ave Bldg C Geneva IL 60134 Phone. The exact property tax levied depends on the county in Illinois the property is located in.

Tax Year 2021 First Installment Due Date. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. The Circuit Clerk is a constitutional officer who is elected every four years by the voters of Kane County.

Tax Year 2020 Second Installment Due Date. Tax bills were mailed April 30 2021 and the first payment is due June 1 2021. 2021 Real Estate Tax Calendar payable in 2022 May 2nd.

Yearly median tax in Kane County. 20 - 423-429 E CHICAGO STREET CONDO. Ad View Past Current Tax Reports for Any Property Within Kane County.

Property tax bills mailed. Tuesday March 2 2021. Illinois has one of the highest average property tax rates in the.

173 of home value. Notice Of Real Estate Tax Due Dates. Tax amount varies by county.

Bldg A Geneva IL 60134 Phone. The County Treasurer. Kane County collects on average 209 of a propertys assessed fair market value as property tax.

The second payment is due September 1 2021. Kane County Property Tax Inquiry. Installments not paid by the due date require a 15 penalty to be added per month.

630-208-7549 Office Hours Monday Thru Friday. Assistance in filling out these forms is available by telephone only at. The median property tax also known as real estate tax in Kane County is 511200 per year based on a median home value of 24500000 and a median effective property tax rate of 209 of property value.

In most counties property taxes are paid in two installments usually June 1 and September 1. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. When are property taxes due in kane county illinois Tuesday February 15 2022 Edit Transfer Taxes What Are They How Much Are They Who Pays Mortgage Blogs Federal Student Loans Private Student Loan.

If your information is corrected in their system email us at treasurercochampaignilus. And we will mail out a. The duties and responsibilities of the Circuit Clerk are established by state statute as well as by the Illinois Supreme Court Administrative Office of Illinois Court and Local Rules set forth by the Chief Judge of the 16th Judicial.

3315 - BUONA ST. 2022 Senior Freeze Tax Conversion Chart converts 2021 federal income tax forms to the 2022 Senior Freeze applications Kane County Illinois - Government Website 719 S. Be 65 or older by December 31 2021.

Late Payment Interest Waived through Monday May 3 2021. 3317 - COURTYARDS OF ST. And Have a total household income as defined below no greater than 65000 in 2020.

Welcome to the Kane County Treasurer E-Notify Service. Tax Year 2020 First Installment Due Date. Friday October 1 2021.

The extension of taxes is computed according to the state statute and no adjustments may be made to assessed valuations or levy rates once the values have been certified to the Clerk. Batavia Avenue Geneva ILYou may call them at 630-232-3565 or visit their website at. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. But that still gives delinquent taxpayers an opportunity to make their property tax payments.

KANE COUNTY TREASURER Michael J. Batavia Ave Bldg A Geneva IL 60134 630-232-3400. Tuesday March 1 2022.

Kane County has one of the highest median property taxes in the United States and is ranked 32nd. If you have not received your tax bill please verify your information is up-to-date with the Supervisor of Assessments at 217-384-3760. County Assessment Office All of Kane County 6302083818 MF 830 am430 pm.

According to the Treasurers Office website payments must be. Contact your county treasurer for payment due dates. Wednesday February 16 2022 Last Day Of Payment Of 1st Half of 2021 Taxes.

3164 - COURTYARDS OF. Kane County Government Center 719 S. CHARLES OFFICE CONDO AMEND PER 2015K018901.

This information is sent to the County Treasurer whose office prepares and mails each tax bill. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Property taxes are paid at the Kane County Treasurers office located at 719 S.

The first installment will be due on or before June 1 2021 and the second installment will be due on or before September 1 2021. Tuesday March 1 2022. Just Enter the Address You Want to Research to Receive Printable Tax Records.

Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021.

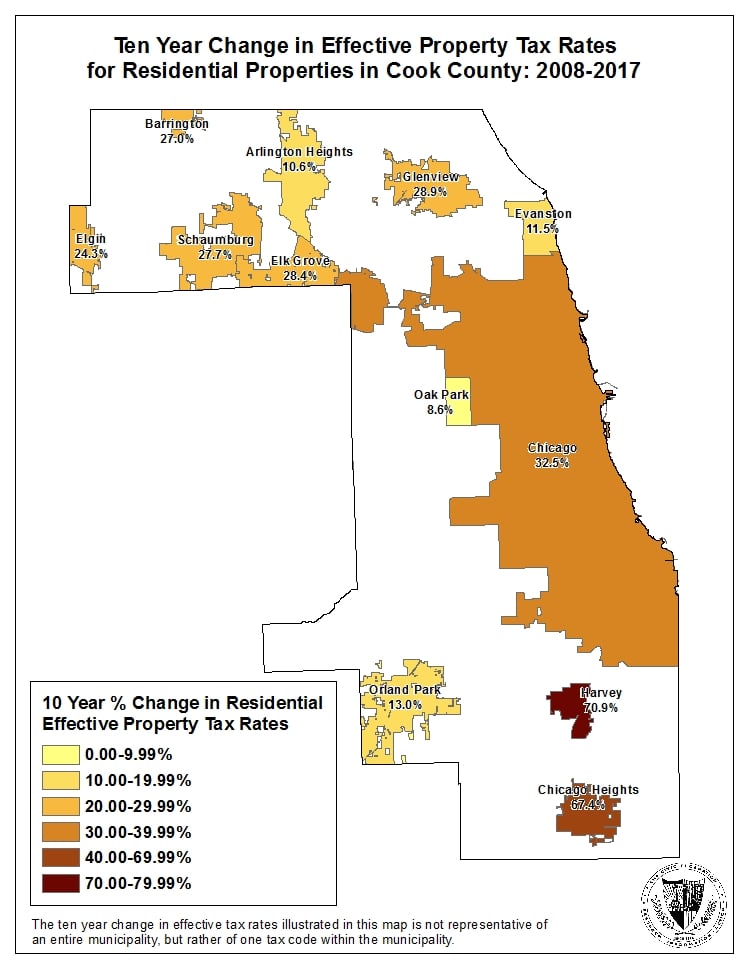

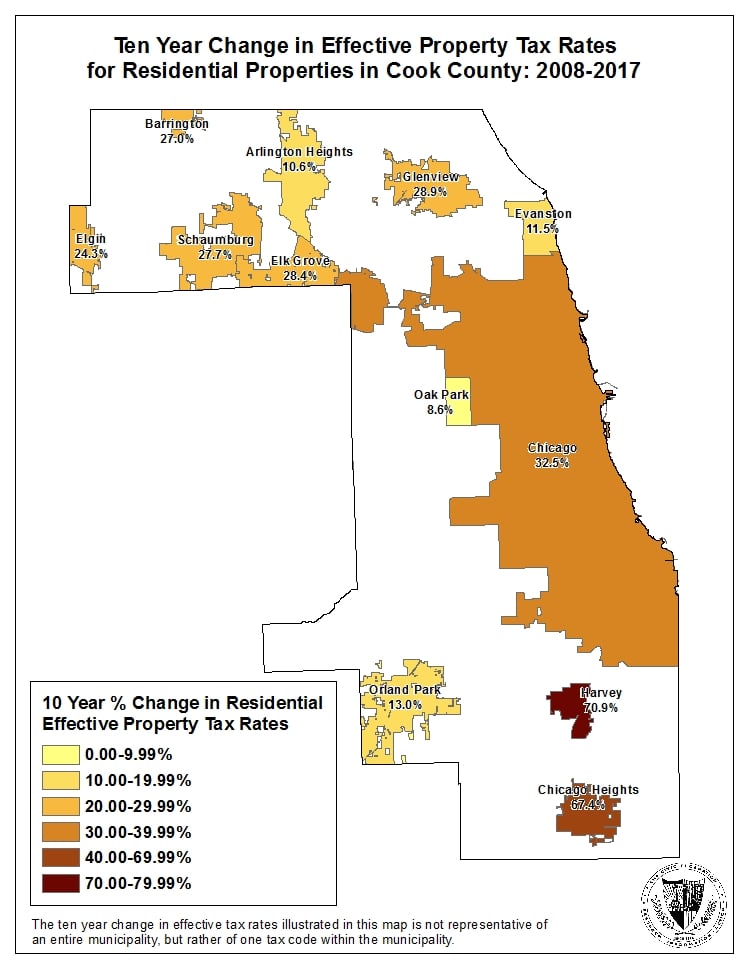

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

How To Find Tax Delinquent Properties In Your Area Rethority

2022 Illinois Tax Filing Season Begins Jan 24 Kane County Connects

Important Reminder Property Tax 2nd Installment Is Due Sept 1 Kane County Connects

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

North Central Illinois Economic Development Corporation Property Taxes

How To Compute Real Estate Tax Proration And Tax Credits Illinois

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/shawmedia/4YLNBN5WBJH3BJNRYP5YLMYNW4.jpg)

Will County Delays Due Dates For 2021 Property Taxes Shaw Local

Cook County Board Of Review Residential Property Tax Appeals Period Open Until February 1 2022

Idor Announces 2021 Kane County Tentative Property Tax Multiplier Kane County Connects

3243 W Sunnyside Ave Unit 2w Chicago Il 60625 2 Beds 1 Bath Sunnyside Chicago Chicago Events

Don T Forget The 2nd Installment Of Your Property Tax Bill Is Due Sept 1 Kane County Connects

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

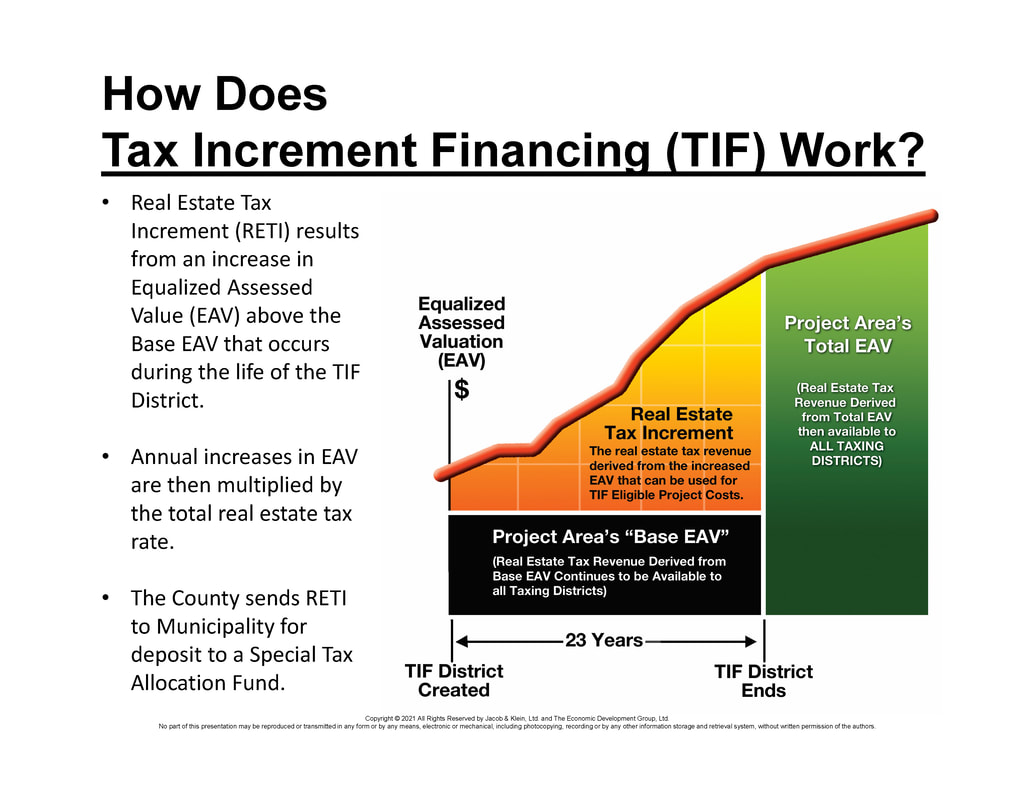

What Is Tax Increment Financing

Cook County Property Tax Bills In The Mail This Week

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation